Income Tax Refund: According to the rules, if you do not verify your ITR within 30 days of filing it, then not only will you have to file the return again but you will also have to pay a fine.

Income Tax Refund: According to the Income Tax Department, about 7.28 crore Income Tax Returns (ITR) have been filed this year till July 31, 2024. Out of these, about 5 crore ITRs were filed by July 26. The remaining 2.28 crore ITRs were filed between July 27 and 31. In such a situation, according to the rules, the deadline for ITR filed between July 26 and July 31 is also falling between August 26 and 30. In such a situation, if you also filed ITR on these dates, then now you have only 10 days left for its verification. In such a situation, you should not delay now to avoid penalty.

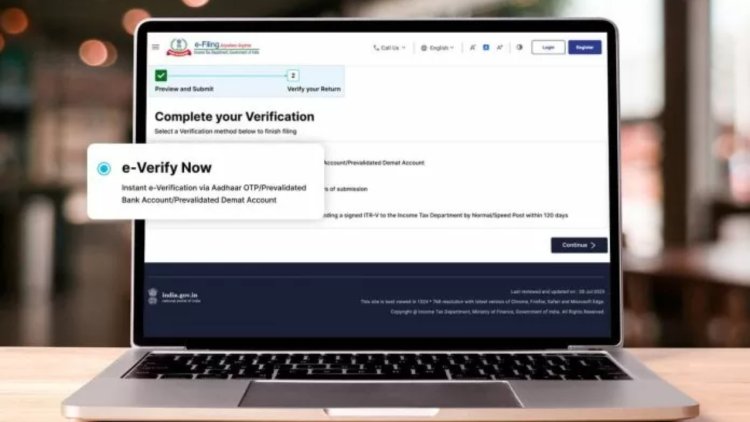

30 days time to submit e-verification or ITR-5

According to income tax rules, you get 30 days time to submit e-verification or ITR-5 offline after filing ITR. According to the information received from the IT Department, a total of 7,41,37,596 ITRs have been filed till August 20. Also, 7,09,89,014 ITRs have also been verified. In such a situation, about 32 lakh people have still not verified their ITR. Apart from this, out of the people who have filed ITR till July 31, about 19 lakh have not yet verified their ITR.

If you want a refund, do the verification within 30 days of filing ITR

In such a situation, you have to take care that there is not more than a gap of 30 days between filing ITR and e-verification. Your refund will come only when you verify the ITR. For example, if you filed your ITR on 31 July, then the last date to verify it will also be 30 August. According to the Economic Times report, if you miss this deadline, it will also be considered late filing. In such a situation, you may have to pay a fine.

Not only will you lose your refund but you may also have to pay a fine of up to Rs 5000

According to the rules, if you do not verify within 30 days, you will not get a refund under any circumstances. In such a situation, you may have to suffer a huge loss due to a small mistake. Also, your ITR will also be cancelled. You will have to file ITR again and will also have to pay a fine for late filing. This mistake can cost you from Rs 1000 to Rs 5000.

- Tags:

0 Comments:

Comments