Income Tax: Sarthak is a youth of the 21st century, he lives in the country’s capital Delhi, and is fond of traveling and eating… He has a good job, and his monthly salary is ₹70,000, but every month his company deposited only ₹64113 in his bank account… The carefree Sarthak never paid attention to this, and after working hard in the office the whole day, he used to go to different areas of Delhi in the evening and try new dishes in different restaurants.

Suddenly, on a holiday in January, his father came to Delhi to meet him, and Sarthak asked him for ₹25,000, because he had already invited his friends to his birthday party… The father immediately gave him the money, but asked whether he had made some investments or not… As soon as Sarthak said yes, his father said, “Then you should not have needed to ask me for money…”

Sarthak was shocked Asked, “What do you mean…?”

Father said, “I made you invest after taking into account your salary, house rent and income tax… So, you should have received more money as salary every month… at least ₹2,500 to ₹3,000 extra every month… Did you tell your company where and how much you were investing…?”

Sarthak replied, “No, I invested as per your suggestion… But I did not know that the company should have been informed about this investment…”

Despite being lost in his own world, Sarthak usually listens to his father’s advice carefully, and often accepts it as well, so he invested as per his father’s suggestion, but the innocent Sarthak who had complete faith in his father’s words did not understand that his father had made him invest to save his income tax, so he would have to inform the office people about the investment, so that the TDS deducted from his salary every month is stopped, and he gets more money every month…

Now the father made him sit next to him, and started explaining… “Yes, I had asked you to invest after calculating your salary and deductions in my mind, and if you had informed the company on time, you would have got about ₹3,000 more every month…”

Sarthak became curious, and said, “What will happen now…? Can nothing be done now, and will I get additional salary only next year…? Please explain it to me in detail…”

The father started speaking, “No, it is not that nothing can be done right now… You can still inform your office about the investment, and at least the TDS deduction from the salary of January, February and March will stop… And not only this, when you file ITR in July, then you will also get back the amount deducted from your salary till now as TDS, as income tax refund…”

Sarthak’s father further said, “Tell your office at the first opportunity… you live in a rented house, and pay ₹15,000 monthly rent… and yes, along with giving this information in writing, you will have to give a copy of the landlord’s PAN card… only this will reduce your monthly tax liability by ₹1,000…”

Looking at Amber with surprise and happiness, Sarthak replied, “Okay… that means I will get ₹1,000 extra every month…”

Father said smilingly, “Absolutely… but you are going to save even more than this… in total about ₹3,000 every month…”

“What else will I have to do, Papa…?”, Sarthak asked…

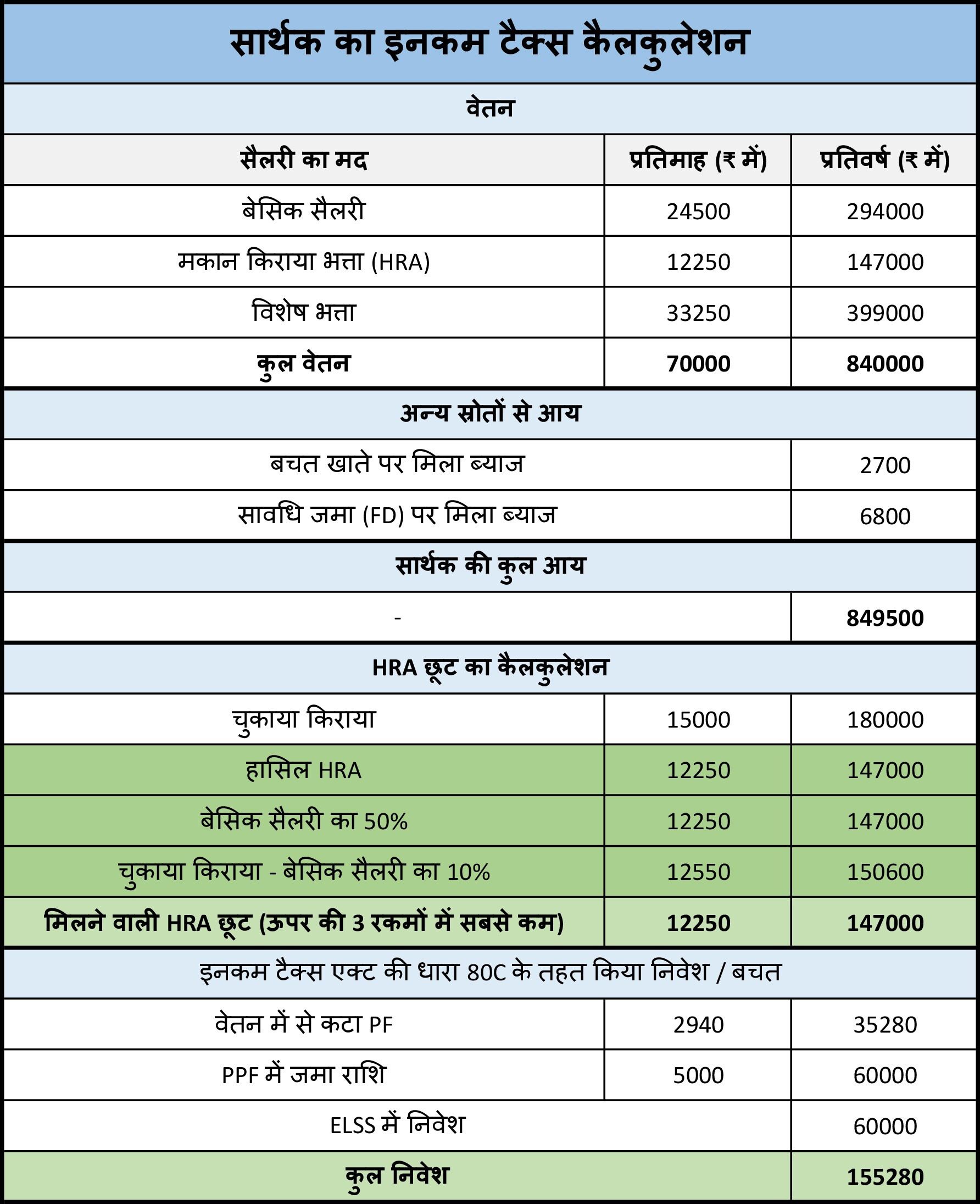

Father said, “Listen carefully… your total salary is ₹70,000 per month, that is ₹8,40,000 per year… your company has no information about your investments, so they will be calculating your income tax by deducting only ₹50,000 Standard Deduction, and will be sending your salary to your account by deducting Provident Fund (PF) and TDS accordingly…”

“Okay… then…?”

“Now your basic salary is ₹24,500 per month out of your total salary, so, your PF deduction is 12 percent, so every month ₹2,940 is deducted from your salary… and after deducting the standard deduction from the total salary, the income tax for each month under the new tax system will be ₹2,946.67, so after the total deductions, ₹64,113 will come to your account every month…”

“Oh yes, you are telling the correct amount, Papa…”

“Now listen… tell me how much have you invested in which heads…”

“As per your request, I deposit ₹5,000 every month in the Public Provident Fund, i.e. PPF account, and I had also deposited ₹60,000 in ELSS in one go…”

“I think this is enough… Now tell me, how much amount has been deposited in your bank account as interest…?”

“Papa, I can tell you the interest in my savings account till December, but the interest on the FD I had made, will be available only when the FD matures on 31st March…”

“Let’s calculate… According to my calculation, approximately ₹2,700 interest will be deposited in your savings account in a year, and you are going to get a total interest of ₹6,800 on the FD, in this financial year… Now this also has to be added to your annual income, and tax will have to be paid on it…”

“Hey, the interest that I will get from the bank on my money, will that also be taxed…?”

“Of course son, you have to pay tax on whatever income you make… But you will get some exemption on the interest received on savings account as per your age under section 80TTA of Income Tax Act, but there is no exemption on the interest of FD…”

“Now let’s calculate… Your total salary is ₹8,40,000, to which will be added the ₹6,800 received as interest on FD and ₹2,700 received as interest on savings account… So, your total income for the whole year will be ₹8,49,500… Now first of all, we subtract the standard deduction, i.e. ₹50,000… So, ₹7,99,500 will be left as taxable income… From this, you will have to subtract the exemption on house rent, which is very easy to calculate… You get ₹12,250 in your salary under the head of HRA… 50 percent of your basic salary is also ₹12,250… Apart from this, you pay rent of ₹15,000, and after deducting 10 percent of the basic salary from it, you get ₹12,550, So the lowest amount out of these three, i.e. ₹12,250 will be your monthly HRA Exemption…”

“That means…?”

“That means we deduct this amount from your taxable income… Now ₹12,250 every month means ₹1,47,000 every year, so we deduct this amount from ₹7,99,500… and we are left with ₹6,52,500…”

“Now…?”

“Now we will deduct from this the amount that you have invested in various places… First of all, ₹2,940 is deducted from your salary every month as PF, so, your PF contribution in a year will be ₹35,280, and at the rate of ₹5,000 every month, you have deposited ₹60,000 in the PPF account during the year… Your third investment of ₹60,000 is in the tax-saving mutual fund scheme ELSS… that means your total savings or investment is ₹1,55,280… Out of this amount, the maximum exemption that can be availed under Section 80C of the Income Tax Act is ₹1,50,000, so, you will get exemption on the entire amount… and after this your taxable income will remain ₹5,02,500…”

“What will have to be done after this, Papa…?”, asked Ujjwal Sarthak It was a question of…

Papa smiled and said, “Now I will tell you about that section of the Income Tax Act, which most people do not know about, or forget… This is section 80TTA, under which interest up to ₹10,000 received on savings accounts is completely exempted from income tax… So, the interest of ₹2,700 received by you on savings account in a year is deducted from taxable income, and now your taxable income will be ₹4,99,800…”

“How much tax will be levied on this…?”

“Son, this amount will be taxable at Rs 12,490 as per the tax slab of the old tax system, but since your taxable income has become less than Rs 5,00,000, you will get exemption on this entire amount under Section 87A of the Income Tax Act, and you will not have to pay even a single penny of income tax…”

“Oh wow… but what will happen to the money that has been deducted from my salary as TDS till December…?”

“You will get that entire amount back when you file your ITR, i.e. Income Tax Return, on time in July… its last date is 31st July, so do it before that… but now first of all go to your office and give information about your house rent and all kinds of investments, so that at least TDS is not deducted from your salary in the remaining months of the financial year, and you get approximately Rs 3,000 extra every month…”

- Tags:

0 Comments:

Comments